Ways to BOOST Your Credit Score

It’s no secret that a great credit score can make getting approved for a loan easier and save a bunch in interest. But what if we don’t have great credit? Improving our scores often seems impossible given our unique financial situations. But there are simple steps you can take now to boost your score.

Check Your Credit Report Regularly

Incorrect information can end up on your credit report; whether it’s fraud or an error. And if you wait too long to discover (and correct) this information, the damage to your score could be substantial.

Luckily, you’re entitled to a FREE Credit Report from each of the three major credit bureaus annually – Experian, Equifax and Transunion. To request a copy of your credit report, simply visit: www.AnnualCreditReport.com.

To better monitor your credit report throughout the year, break up your requests. For example, request your Experian report in April, your Equifax report in July and your Transunion report in October. This will provide you with continuous monitoring of your report vs just once a year.

Exercise Control

Nowadays it’s too easy to rack up credit card debt. Rarely do you even find people carrying cash on them anymore. And online shopping keeps credit card spending at all-time highs.

To keep your spending in check, use this simple rule of thumb: Never spend more than 25% of your approved credit limit. If you have a $4,000 credit limit on your credit card, never have a balance over $1,000. This helps keep your score higher and demonstrates to lenders you’re able to responsibly manage debt.

Always Pay on Time

While your goal should be to pay off your credit card balance in full each month, this is not always possible. If you are unable to pay the full balance each month, ALWAYS do your best to pay at least the minimum balance. Missing payments can significantly lower your credit score.

You should always aim to pay at least the minimum balance due each month, more whenever possible.

Keep Old Accounts Open

Paying off a credit card feels great. In fact, we often want to cancel the card and never use it again. But did you know keeping that pesky credit card open with a $0 balance actually helps your credit score?

Let’s see how:

Imagine you have 3 credit cards – each with a $5,000 credit limit. You have a balance of $1,000 on one of those cards.

Balance Credit Limit

Card A :: $1,000 $5,000

Card B :: $0 $5,000

Card C :: $0 $5,000

Your total debt is $1,000 out of $15,000 available.

Meaning, you’ve spent roughly 7% of your available credit.

Now imagine you close the 2 credit cards with a $0 balance.

Balance Credit Limit

Card A :: $1,000 $5,000

Your total debt is $1,000 out of $5,000 available.

Meaning, you’ve spent 20% of your available credit.

Lenders want to see that you’re able to manage debt responsibly. Having additional credit available to you, but not using it, demonstrates your ability to do just that.

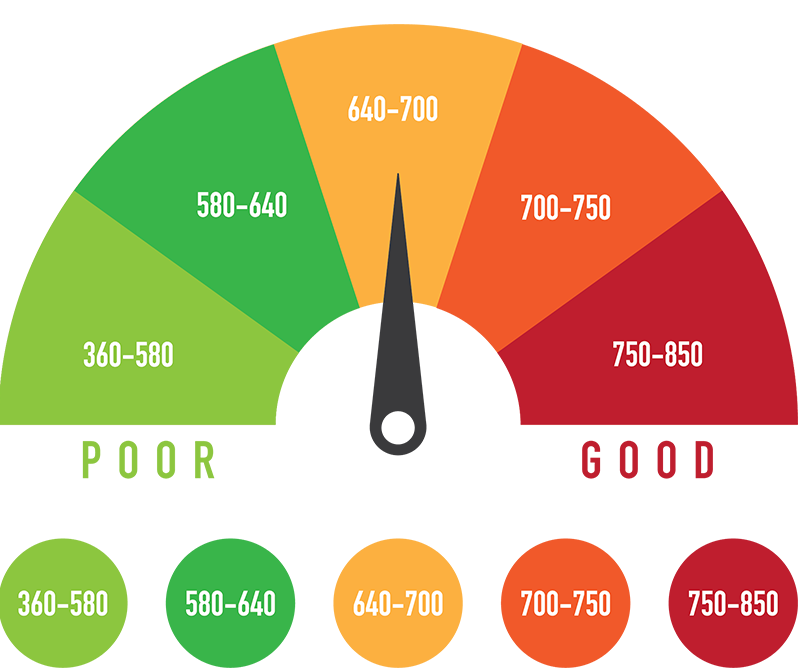

Get Extra Help

There is no single number than can impact your financial situation more than your credit score. Make an effort to check your credit report throughout the year and use these tips to help keep your score moving up.

Financial Access Federal Credit Union is Here to Help.

We’re happy to answer any questions you have and are usually able to find ways to help you save money on your current loans financed at other institutions – and who doesn’t like saving money?!

Each individual’s financial situation is unique and readers can talk with a credit union representative at 941-748-7704 ext. 125 when seeking financial advice on the products and services discussed. This article is for educational purposes only; the authors assume no legal responsibility for the completeness or accuracy of the contents.

« Return to "Blogs"